Idenfo Direct won Best Regtech Solution Award at the MENA Fintech Association Awards 2024

Simplify identity verification: offer your users quick, easy onboarding and keep the fraudsters off your platforms.

Built for Security. Designed for Simplicity.

Our identity verification and AML/KYC platform combines cutting-edge technology with classic, intuitive design. Whether you’re onboarding new customers or ensuring regulatory compliance, we provide everything you need in one seamless solution.

Benefits:

- Reduce onboarding time by 80%

- Prevent fraud with AI-powered precision

- Comply with local and global regulations (FATF, FCA.)

Seamless Digital Onboarding

Instant Verifications for Fraud Prevention

Identify High-Risk Individuals with Name Screening

Comprehensive Screening

Stay Compliant: AML Compliance Made Simple

Flexible Risk Management: Your Way

Powerful Solutions Tailored to Your Needs

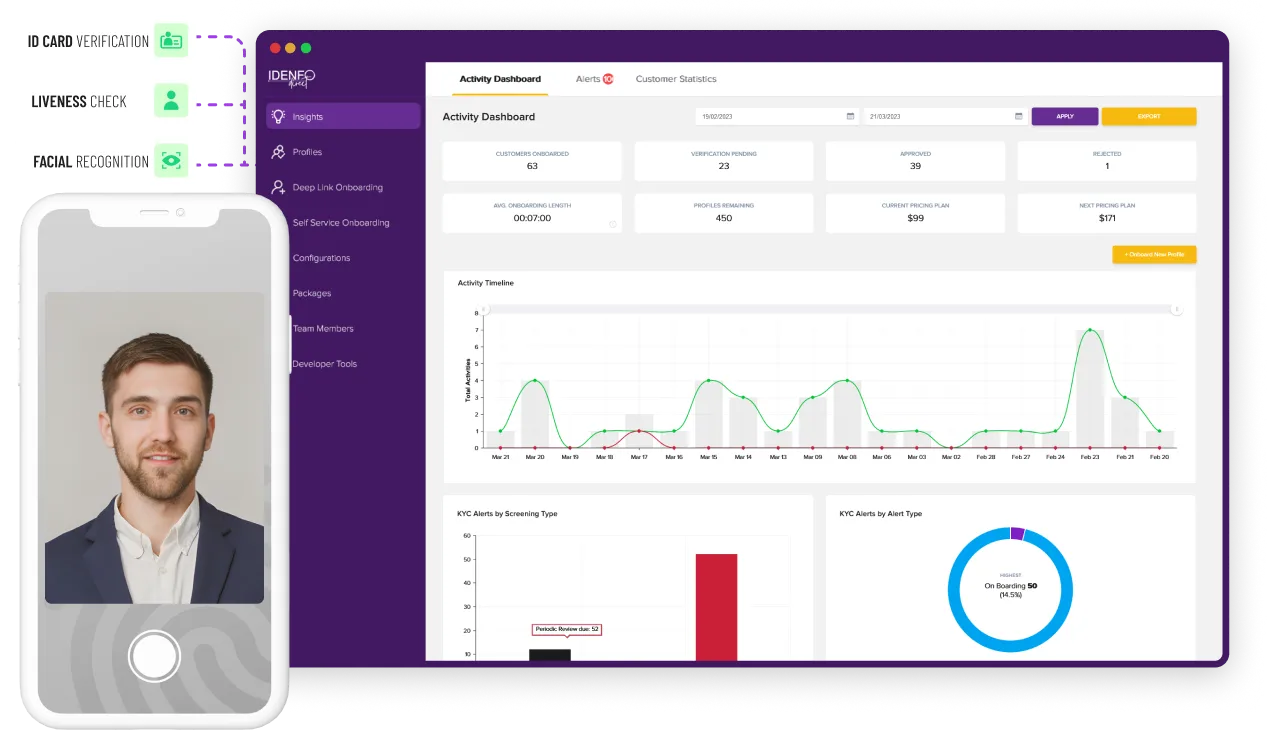

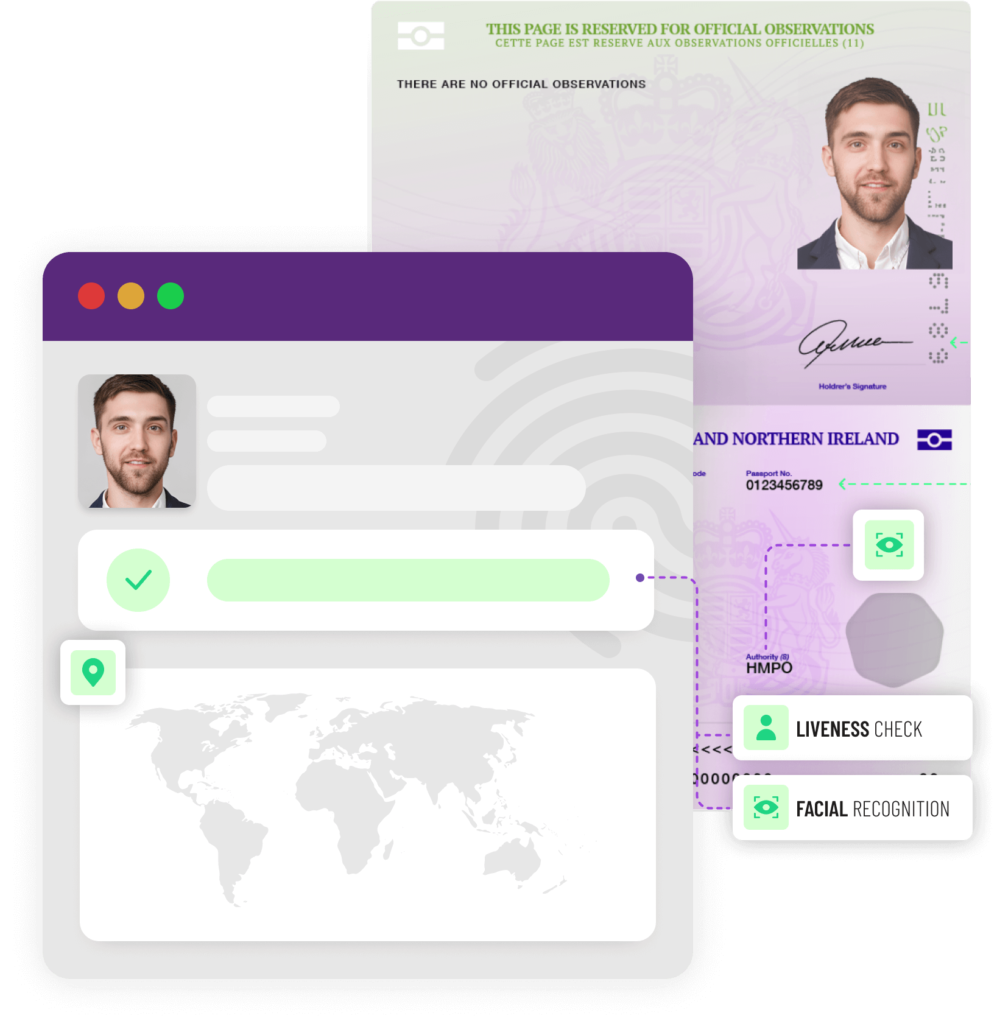

Real-Time Identity Verification

Our advanced biometrics, facial recognition, and document checks allow you to verify users in real-time. Know your customer – with up to 99.9% accuracy.

AML/KYC Compliance

From onboarding to reporting suspicious activities, keep your AML accurate, automated, and agile.

Global Coverage

Verify documents from over 200 countries and territories. Our platform supports various document types, making global onboarding simple and reliable.

AI-Powered Fraud Detection

Leave no suspicious stone unturned: Master fraud detection with our state-of-the-art machine learning algorithms.

Seamless Integration

Easily integrate our solution with your existing systems. Your CRM, our APIs. Your platforms, our SDKs. We’ve got you covered.

Documents we support

Residents

BRP Biometric Residence Permits

Issued by the Home Office

Passports

Issued by the HM Passport Office to verify the nationality, name, and DOB of customers

Driving licence

Issued by DVLA

Non-Residents

Passports

Passports issued by any country to verify identity and perform risk assessment

Solutions Tailored for Your Business

Fintech & Financial Institutions

Streamline KYC/AML checks, reduce onboarding friction, and safeguard your business from financial crime with our robust compliance platform.

Legal & Real Estate

Meet regulatory requirements and verify the identities of clients quickly. Our platform helps solicitors and real estate agents remain compliant without slowing down transactions.

Solution for Insurance Agents, Accountants, and Jewelers

Safeguard your business from financial crime by verifying clients and transactions in real-time. Whether you’re issuing policies, managing accounts, or selling high-value items, our platform ensures compliance with AML/KYC regulations, protecting you from fraud and enhancing client trust.

How it Works

A Simple, 3-Step Process

Capture Data

Collect documents and biometric data from users with our easy-to-use interface.

Automate Verification

AI-powered checks are run, cross-referenced, and re-run against global databases.

Stay Compliant

Generate regular reports to screen for suspicious activity, and receive alerts in real-time.

Industries We Support

onboarding and retaining a greater customer base.

Property

Insurance

Accounts

Law

Flexible Pricing to Fit Your Business Needs

Whether you’re a startup or an enterprise, we have a pricing plan that fits your needs. Explore our flexible plans and see how you can start verifying identities today.

STARTER

£299

/Year

- Up to 100 profiles

- All prices are exclusive of VAT

ESSENTIAL

£529

/Year

- Up to 250 profiles

- All prices are exclusive of VAT

BUSINESS

£999

/Year

- Up to 500 profiles

- All prices are exclusive of VAT

CORPORATE

£1,399

/Year

- Up to 750 profiles

- All prices are exclusive of VAT

ENTERPRISE

£1,699

/Year

- Up to 1000 profiles

- All prices are exclusive of VAT

STARTER

£389

/Year

- Up to 100 profiles

- All prices are exclusive of VAT

ESSENTIAL

£688

/Year

- Up to 250 profiles

- All prices are exclusive of VAT

BUSINESS

£1,299

/Year

- Up to 500 profiles

- All prices are exclusive of VAT

CORPORATE

£1,819

/Year

- Up to 750 profiles

- All prices are exclusive of VAT

ENTERPRISE

£2,209

/Year

- Up to 1000 profiles

- All prices are exclusive of VAT

PRO

Features

- Self Service and Excel Onboarding

- Deeplink Onboarding with Digital Signature

- Name Screening (Sanction, PEP, Special Interest, Adverse Media)

- Individual Risk Assessment and Business Risk Assessment

- KYC and KYB (UBO, Shareholders, Directors, etc.)

- EDD (Enhanced Due Diligence)

- Email Notification on Document Expiry

- Liveness Detection Check

- User Invite/User Role

- Activity Log

- Document Storage

- STR Records

- Data Updated Every 24 Hours

- Download Report (Excel & PDF)

- Online & Onsite Support

- Software Training Video & Manuals

- Global Coverage

- OCR and Document Verification

- Graphical Representation & Customer Statistics

- Periodic Check & Ongoing Monitoring

- Linking Individual/Shareholder and Company

- Adverse Media Exact Name Match

PREMIUM

Features

- Self Service and Excel Onboarding

- Deeplink Onboarding with Digital Signature

- Name Screening (Sanction, PEP, Special Interest, Adverse Media)

- Individual Risk Assessment and Business Risk Assessment

- KYC and KYB (UBO, Shareholders, Directors, etc.)

- EDD (Enhanced Due Diligence)

- Email Notification on Document Expiry

- Liveness Detection Check

- User Invite/User Role

- Activity Log

- Document Storage

- STR Records

- Data Updated Every 24 Hours

- Download Report (Excel & PDF)

- Online & Onsite Support

- Software Training Video & Manuals

- Global Coverage

- OCR and Document Verification

- Graphical Representation & Customer Statistics

- Periodic Check & Ongoing Monitoring

- Linking Individual/Shareholder and Company

- Adverse Media Exact Name Match

- Adverse Media Rescreening

- Whitelabeling license (included at a one time fee of 1000 GBP)

For more customised plans or our SDK

FREQUENTLY ASKED QUESTIONS (FAQs)

You can sign-up here by simply entering your name, email address, and country.